FxPro: Your Complete Review and Guide

FxPro is a Forex broker that started its online operations back in 2006 and has only gotten better with time. Having won many awards for being one of the best brokers in the industry, it still delivers the best services to its customers. It has offices across the world that enables it to better serve its diverse clientele spread in every corner of the world. With years of experience under its belt, it's no wonder many customers prefer it as their broker of choice.

FxPro has over 1.3 million investor accounts opened by traders worldwide who come for the abundance of tradable instruments. It has managed to hire over 200 employees manning offices in many jurisdictions where it's licensed to operate. This is a company that has managed to win over 70 awards in all the years of its operation beating even the top companies in the industry.

Traders get to enjoy choosing from four different trading platforms for the best. These are Meta Trader 4, Meta Trader 5, cTrader, and the new FxPro Edge Trader. The choice of instruments is quite diverse with CFDs on Forex, Spot Metals, Indices, Shares, Futures, and Energies. Novice traders can start by using the demo account to sharpen their skills before progressing to the live accounts.

Is FxPro a Reliable FX Broker?

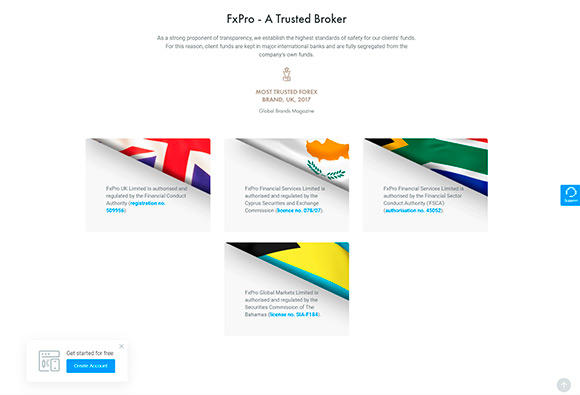

With so many awards under its belt, this is a platform trusted by its users and has been rewarded over and over for these great services. Apart from awards, it's fully licensed and regulated by some of the top and most respected authorities in the world. For its operations within the European Union, this trading platform is licensed and regulated by CySEC (Cyprus Securities Exchange Commission) which is one of the most respected authorities in the region. This is under license number 078/07. This regulator is part of the ESMA (European Securities and Markets Authority) which is a board of supervisors.

The next regulator is the Financial Conduct Authority (FCA) that is based in the UK. This is yet another respected and revered regulator whose license is important for top brokers to acquire. The platform is under license number 509956. This is a financial regulator that acts independently of the British government and all its members must pay a fee.

Another regulator that keeps an eye on brokers within Africa is the Financial Sector Conduct Authority (FSCA) based in South Africa. This is a regulator of financial services in South Africa that are non-banking. This broker is under license number 45052. Lastly, there is the SCB (Securities Commission of the Bahamas) which is a regulator of trading platforms operating in the Bahamas. This is under license number SIA-F184.

Types of Accounts

There are various types of accounts you can open on this broker depending on the trading platform you select. As a new trader, the best place to start is by creating a demo account to test your skills and practice with virtual funds.

FxPro Demo Account

The demo account is the best place for any trader just starting to test their skills and sharpen their knowledge. You don't get charged any fee to open or even use the account and it comes with virtual funds for you to utilize as you see fit. You can't withdraw these virtual funds but can test them with any trading strategy that you have in mind.

Learn as much as you can from this area before you proceed because there are zero risks involved so you can stretch as far as you please. The instruments available for trade are the same as on live accounts and portray the real and everyday market scenarios. Make use of the trading platforms then get started on the live account when confident about your skills.

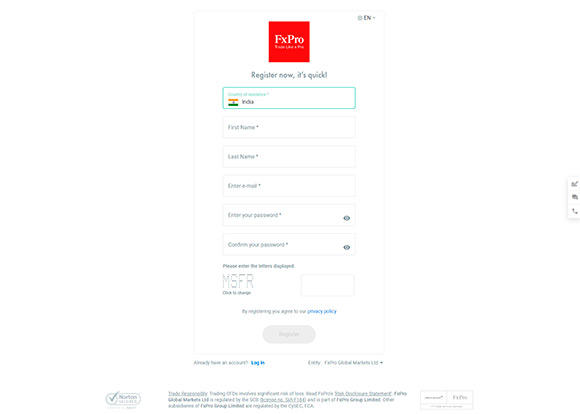

To set up a demo account:

- Open a blank browsing page and input the FxPro web site www.fxpro.com

- To open a demo account, you should scroll through the loaded homepage to about halfway down.

- Select a trading platform from the three provided namely MT4, MT5, and cTrader.

- Click on the platform you've chosen to open the demo account with then follow this by filling the registration form that appears on your screen.

- Fill in your Country of Residence, First name, Last name, email, and then create a unique password known only by you.

- Click on 'Register' after completing the information to proceed to the next page.

- Fill in your Residential Address and Personal details including Date of birth, Mobile phone number, and Country of Birth.

- Click on 'Next Step' to proceed.

- Fill in your Employment Information, Financial Information, and answer questions on your Trading Experience.

- After completing this step click on 'Next Step' and the check the boxes on the page that loads. These are to accept the Terms and Conditions and accept to receive Daily Analysis as well.

- Choose your preferred language for communication then check the box to declare the account is for purely speculative trading.

- Complete the process by clicking on 'Complete' then proceed to your email to confirm and activate the account. Click on the link sent to you and log in.

- Once you log in, click on 'Demo Accounts' on the dashboard then on 'Create New Account'. Finish by selecting the trading platform, leverage, currency, and amount in virtual funds to get then click on 'Create'.

- You can now start using the demo account to trade.

Live Accounts

When it comes to opening the live accounts here, you should choose a trading platform in the process. A live account uses real money to trade therefore you must use one of the provided methods to fund it. Observe the minimum deposit accepted by each account.

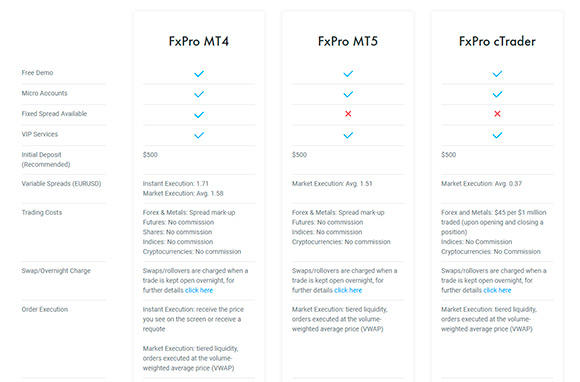

- MT4 Account

With this type of account, you won't be charged any commission to use it. You start by learning about one of the best trading platforms available in trading. This account is best suited for traders in need of a hedge account where spreads can be fixed and are just low enough. This type of account is the best place for novice traders to start.

- MT5 Account

This account grants you access to the more advanced Meta Trader 5 platform with more advanced tools and trading features than the MT4. No commission is charged on this account as well and spreads are competitive. The professional traders will enjoy all that this account has to offer.

- cTrader Account

This account is set up on another type of trading platform that has gained popularity and a good reputation over the years. Here you can learn as much as possible on cTrader as you keep trading using the same platform. The spreads for this account start from as low as 0 pips. There is a commission charged on this type of account.

- Edge Account

This is a new type of account established on the FxPro Edge platform that was recently launched by this broker. This type of account and trading platform are only available to traders based in the UK.

- FxPro VIP Account

You can opt to open a VIP account and enjoy various features. You get market spread discounts ranging up to 30% and have no restrictions when accessing VPS (Virtual Private Server). The VIP account gives you 30% off the commission charged on cTrader account. You must submit a request to gain access to a VIP account.

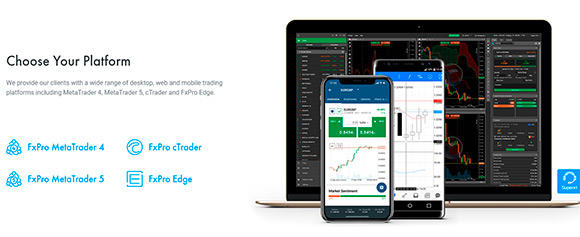

Trading Platforms

When it comes to trading, you should use a trading platform that you can easily download on your desktop or mobile device. The trading platforms available are Meta Trader 4, Meta Trader 5, cTrader, and FxPro Edge Trader.

Meta Trader 4

The MT4 is a popular trading platform among traders and the best place for novice traders to start. It has a user-friendly interface that is engaging and gets you excited as you start trading. There isn't any complex language used and navigating it is simple. Download it on your desktop or mobile device. The one advantage of this platform is the fact that it's compatible with Windows, Android, and iOS.

Make use of this advanced trading technology with prices that are quite competitive. The execution of orders on this platform is fast and you mustn't seek any assistance due to delays.

Features include:

- Trading on instruments such as spot metals, energies, forex, indices, futures, and shares

- Fills used are not partial in any way

- There are micro-lots available on this trading platform.

Meta Trader 5

When you decide you want to use a more advanced trading platform then the Meta Trader 5 is the best place for you. It has the same amazing and top of the range user-friendly interface as the MT4 which makes transitioning between them easy for you. It gives you access to all you require to place the best trades in the market at any time. You have the option of customizing it to suit your preferences.

Features include:

- Spread starting from as low as 0.6 pips

- Fast execution of the market

- EAs that have IDE (Integrated Development Environment)

- Chart trading using a tick

- Detailed information and analysis on the market

- Stop limits for buy and sell of all orders

cTrader

This is a fairly new type of trading platform taking on the more established Meta Trader. It's managed to create a loyal following in the few years of operation with its intuitive interface and in-depth analysis of the marketplace. You get the best bids and ask prices in the market even from companies that are competitive.

Features include:

- Spreads start from as low as 0 pips

- Execution of the market is full

- Stop levels have no restrictions

- Full-depth analysis of the market

Trading Instrument

There are various trading instruments to choose from on this platform. You can trade on the ones you want to diversify your portfolio spreading risk in the process. These instruments are Forex, Futures, Indices, Shares, Metals, and Energies.

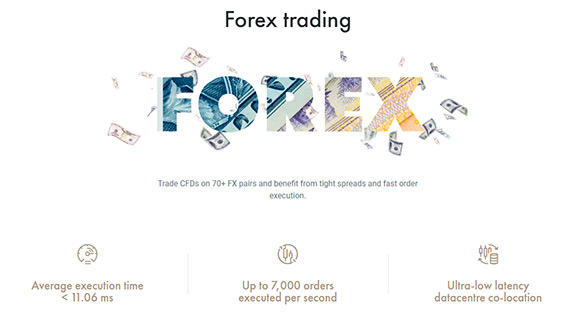

Forex

Forex means trading in currencies from around the world. This trade takes place in the Foreign Exchange which is the most popular market instrument of all. It sees the most trade and traders get to buy and sell currency pairs. For FxPro, you can access more than 70 types of currency pairs while benefiting from some of the tightest spreads in the industry. The execution of the order is fast taking an average of 11.06 ms.

This broker manages to have more than 7000 orders executed in every second that passes by. It has latency that is extremely low.

Futures

Here you can trade CFDs on Futures which give you access to markets all across the world plus trading opportunities that are infinite. With futures, you get into a contract with another buyer or seller. One party involved agrees to buy a set amount of a certain product and the seller agrees to provide it at the agreed time. You need a good starting capital to start benefiting from trading futures. The best way to spread the risk involved is to have it as one of the trading instruments in your diverse portfolio.

Indices

Indices are stock indexes that are a popular vehicle for trading but the fact is they aren't supposed to be directly traced. This is a collection of stocks whose movement is based on the stocks themselves. An example of these stock indexes is the FTSE 100 that represents 100 large stocks that you can find on the LSE (London Stock Exchange).

Shares

Trading on shares involves speculating on their price the buying or selling. This is done online and is purely speculative meaning you don't get to own the shares that you trade on. Shares are popular among traders and you get to trade on those of the most popular companies in the world on the stock market.

Metals

Metals are stable and are a way of making your portfolio even more stable and diverse. You get to trade on instruments like silver and gold that are considered precious metals and are valuable. Metals are considered stable in their value as they never get affected by events in the market that cause price fluctuations in other instruments. This stability in pricing with minimal fluctuation is what attracts many traders to include them in their portfolios.

Energies

Trading in energies is another way to increase the diversity in your trades as you can trade on crude oil, natural gas, and wind power. This instrument attracts many speculators due to the volatile nature where prices tend to fluctuate quite often affecting global economies.

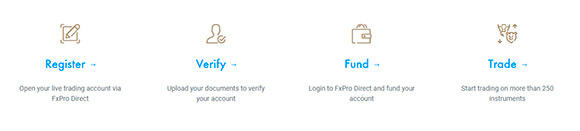

How to Open an Account

Set up a live account if you want to start on all these trading instruments available on this platform. The process takes some time from start to finish. Ensure you provide only accurate information as requested by the broker. To open an account, select a trading platform.

To open a live account:

- Open a blank browsing page and input the FxPro web site.

- To open a live account, scroll through the loaded homepage to about halfway down.

- Select a trading platform from the three provided namely MT4, MT5, and cTrader.

- Click on the platform you've chosen to open the demo account with then follow this by filling the registration form that appears on your screen.

- Fill in your Country of Residence, First name, Last name, email, and then create a unique password known only by you.

- Click on 'Register' after completing the information to proceed to the next page.

- Fill in your Residential Address and Personal details including Date of birth, Mobile phone number, and Country of Birth.

- Click on 'Next Step' to proceed.

- Fill in your Employment Information, Financial Information, and answer questions on your Trading Experience.

- Click on 'Next Step' to verify the profile which is done by uploading a picture of your ID card/passport/driver's license the front page then the back page. Upload proof of residence in the form of a bank statement with a visible address.

- Proceed to log into your account and select the trading platform to use.

- Follow this by depositing funds then start trading.

How to fund FxPro account?

Deposit funds into the new trading account before you can start placing trades on the numerous instruments. The broker has some accepted methods that you can choose from for this process. Depositing money is easy and takes a short while to accomplish. The methods that you can use include Direct Bank Transfer, Credit/Debit Cards, Paypal, Skrill, Neteller, Union Pay, mPay, Fasapay, WebMoney, Moneta, Boleto, Netbank, among others.

- Open a blank browsing page and input the FxPro website.

- Once the homepage loads, navigate to the area written 'Deposit Funds' and click on it

- Fill in the requested information and select the method you prefer to use among those provided.

- Complete the process and wait for the money to reflect on your trading account. The process might take time depending on the method you use.

How to Withdraw Money

Withdrawing money from your trading account uses the same method as when depositing. Take note that you can only use the same method to withdraw that you used to fund your account. Processing the payout request might take time depending on the method you choose to use.

- Open a blank browsing page and input the FxPro website.

- Once the homepage loads, navigate to the area written 'Withdraw Funds' and click on it

- Fill in the requested information and select the method you prefer to use among those provided.

- Complete the process and wait for the money to reflect on your account. The process might take time depending on the method you use.

FxPro Pros and Cons

This is one broker that has managed to create great services for its customers winning numerous awards for it over the years. Most recently it was awarded the 'Best FX Provider 2019' at the Online Personal Wealth Awards. Other wins include the 'Best Broker 2018' awarded at the Financial Times and Chronicles Awards and the 'Best FX Service Provider 2018' awarded at the City of London Wealth Management Awards. This shows this company has managed to gain a reputation as a reliable service provider.

Pros

- Award-winning broker with over 70 awards

- 4 trading platforms to choose from

- Numerous trading instruments to diversify your portfolio

- Demo account for practicing your trading skills

Cons

- Long registration process

FAQ

⚖️ Is FxPro regulated in the UK, South Africa, India, Nigeria, Kenya, and other countries?

Yes, this broker is regulated in all the regions and countries it operates from. It has licenses from authorities like CySEC, FCA, FSCA, SCB, among others.

🙋 How to open a FxPro Demo Account?

Navigate to the middle area of the homepage to get where to create a demo account. Click on 'Create Demo Account' and start the registration process. Fill in all the requested information accurately.

🔐 How can you close a FxPro account?

To close a FxPro account, start by logging into it using your username and password. Open the Live account and then click on it to get the drop-down list. Click on the button to 'Remove Account'.

🎁 Does FxPro provide investors with any bonuses?

No there are no bonuses provided by this broker

⚙️ What instruments are can you access from this broker?

Forex, Shares, Energies, Stocks, Futures, and Indices

📱 Does FxPro have an app?

Yes, there is an official app that you can download on your Android or iOS smart device. It has a user-friendly interface and is fully functional.

Conclusion

This broker has been in operation since 2006 and managed to create a reliable platform that all traders can use. It's a winner of over 70 different awards over the years managing to gather over 1.3 million users. It has numerous trading instruments that you can use to diversify your portfolio. Novice traders can start at the demo account to sharpen and improve their trading skills before setting up a live account. This is a fully licensed and regulated broker keeping it transparent and honest in all its operations.

Risk Warning

We understand the Forex industry is huge and volatile for people who lack basic knowledge about online trading. If you are a beginner, you should make this site your companion (and please practice trading skills on free demo accounts, don't invest real money if you are beginner: remember, Forex trading, as long as trading binary options, crypto or CFDs, carries a risk of losing money due to leverage. About 77% of retail investors lose money when trading CFDs). Read in other languages: RU, VI.