FXTM (Forex Time): Your Complete Guide and Review

FXTM is a globally renowned, licensed and regulated broker that strives to keep providing the best trading services to its clients. With years of experience in the industry, it's managed to establish an award-winning platform that traders can use for their daily trading activities. As a beginner in the world of Forex trading, you can start with a demo account before establishing a live one where you tread with real money.

FXTM Facts and Figures

FXTM or ForexTime is a company that was founded back in 2011 and has managed to establish itself among the most recognized brokers. Its rapid growth over the years has seen it spread globally with offices in Mauritius, Cyprus, and the UK. You can take part in trading on this platform on various instruments including currency pairs, precious metals, energies, CFDs, Indices, and Cryptocurrency.

This platform specializes in trades that are leveraged improving the chances of turning a profit on your placed investment on the various instruments. You can start using it as a beginner in trading or one with years of experience. You join over 2 million other users from all across the world. It has operations in 150 countries and the website can be translated into 18 different languages.

Benefit from all the free education courses and live webinars that help you learn all about trading. You can visit the company news to learn all the latest developments in the industry including advances made by this broker as well. Trading costs are reasonably low with execution that is remarkably fast. Platforms used are MT4 and MT5 which can be accessed on desktop or mobile devices.

Is FXTM a Reliable Forex Broker?

FXTM has years of experience and since being established back in 2011 has managed to get over 2 million clients to join it. With its continuous growth, it proves to users that it's an honest and transparent broker that offers only the best for its customers. It's licensed and regulated to operate as a trading platform with a presence in 150 countries. Its regulation is in several jurisdictions around the world.

One regulator in Europe is CySEC (Cyprus Securities and Exchange Commission) which is one of the main regulators for brokers operating within the EU. It's licensed to operate within this region under license number 185/12. Within the same region, another regulator that this broker is under is the FCA (Financial Conduct Authority) located in the UK. The UK is one of the locations for FXTM's global offices. The license number for this broker under this regulator is 600475.

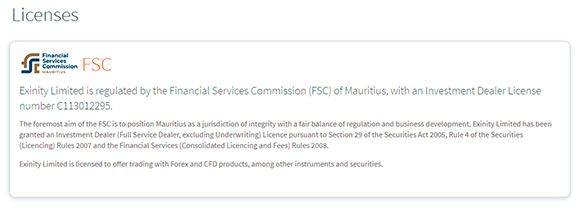

Outside of the EU, another regulator that is trusted and many brokers strive to get licensed by is the FSCA (Financial Sector Conduct Authority) in South Africa. This is under license number 46614. In Mauritius which is another branch office for this broker, it's regulated by the FSC (Financial Service Commission) under license number C113012295.

On top of being legally licensed and regulated, this company has managed to win 25 awards in the few years it's being in operation. This proves it's a legitimate and reliable broker that customers can trust to get the best trading services in the industry. Recently in 2019, it won three top awards which are the 'Best European Forex Affiliate Broker Programme', 'Best Investment Broker' and the 'Best Trading Experience'.

Types of Trading Accounts

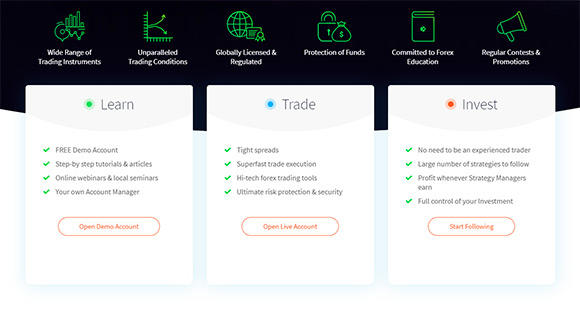

For every broker, there are various accounts you can select from when deciding to open a live account. For a beginner, it's best to start with a demo account then venture to the type of account that requires the least minimum deposit to start you off in real trading.

Demo Account

A demo account is the best place for a beginner in trading to learn all that's required to trade successfully. You get a free account with virtual funds and trade in a real environment with actual trading instruments. Take advantage of all the content in the education section to learn as much as you can on trading then practice it all on the demo account. Here you can employ all the trading strategies to master the best one for you.

On this platform, opening a demo account is quite easy. All you can do is:

- Open a blank browsing page and input the FXTM website www.forextime.com

- Once the homepage loads, click on 'Trading Accounts'

- Select 'Trading Account Comparison' from the provided list

- Once the page loads, navigate to the reading info for Demo Account and click on 'Forex Demo Account' that's highlighted

- This takes you to a page with all the info on demo accounts and their benefits. On the right side of the page, click on 'Open Demo Account'

- Fill in all the requested information accurately. Start with your First name, Last name, Country of Residence, Mobile phone number, Email, and a unique password.

- Click on 'Send PIN' to get a number on your phone that you must fill on the provided space.

- Accept to receive marketing info from the broker by clicking on the checking box.

- Finalize the process by clicking on 'Register now'. You can start using the demo account to practice all your trading skills and strategies.

Live Accounts

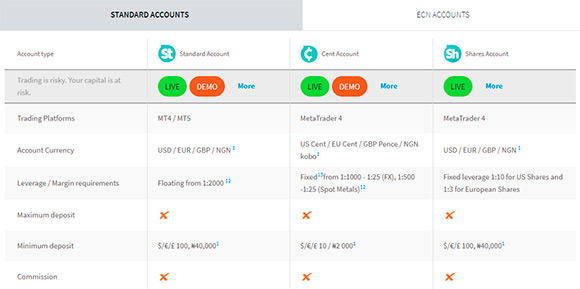

This broker has 3 types of live accounts for its customers to choose from. Go through them and decide the one that best suits your trading requirements.

- Standard Account

This account requires a minimum deposit of $100 to operate. You can either transact using USD or EUR depending on your preference. There is no set maximum deposit amount. The trading platforms used by customers on this type of account are MT4 and MT5 and maximum leverage is up to 1:2000. There is no commission charged to account holders and execution is instantaneous.

The trading instruments to trade on with the standard account are Currency pairs, Spot metals, CFDs, and Cryptocurrencies. All the limits and spot levels are 1 spread with a margin call of 40%. Spread starts from as low as 1.3. Only the MT4 is Swap-free, MT5 is not.

- Cent Account

For this account, you require a minimum deposit of $100 to operate. You can either transact using USD, GBP, or EUR depending on your preference. There is no set maximum deposit amount. The trading platform used by customers on this type of account is the MT4 and maximum leverage is up to 1:10 for shares from the US and 1:3 for those from Europe. There is no commission charged to account holders and execution is instantaneous.

Instruments to trade on with the standard account are Currency pairs that are the major and minor ones and Spot metals only. All the limits and spot levels are 1 spread with a margin call of 60%. Spread starts from as low as 1.5. The MT4 is Swap-free.

- Shares Account

To open this type of trading account, you require a minimum deposit of $10 to operate making it ideal for a beginner. This is after using the demo account to sharpen your trading skills. You can either transact using USD, GBP, or EUR depending on your preference. There is no set maximum deposit amount. The trading platform used by customers on this type of account is the MT4 and maximum leverage is up to 1:1000. There is no commission charged to account holders and execution is instantaneous.

With this type of account, you exclusively trade in shares from the US and Europe and no other instruments. All the limits and spot levels are 1 spread with a margin call of 40%. Spread starts from as low as 0.1. The MT4 is Swap-free.

FXTM Trading Platforms

With this broker, you must not rely on only one trading platform as you can choose between the Meta Trader 4 and Meta Trader 5. They're both accessible from any of your devices no matter if their Android, Windows, or iOS. Simply download the software easily and start using it after installation.

Meta Trader 4

This is a trading platform made using the latest technology to benefit traders from all across the world using various devices to trade. This broker makes it easy to download and install it on your desktop or mobile devices in a matter of minutes. it has the best features of any other software in the market and you get to benefit by using it on this trading platform. It has a wealth of tools used for market analysis and you can use any strategy you want on it without limitation. Create your strategies or use any you can find to make the best investment choices.

The good thing about the MT4 is you can trade on any instrument you want provided it's available on this platform and permitted by the type of account. This means you have a chance to diversify your portfolio which immensely minimizes the risk involved as you trade. There are numerous educational materials provided by this software on the best ways to use it as you trade and earn a profit from the investment made. Utilize the demo account for MT4 and practice trading before you use it on the live accounts.

9 Features of the MT4:

- A user-friendly interface that's easy to use for beginners and experienced traders.

- It keeps your machine or device working at a good pace with minimal interference.

- Customize it to suit your needs by developing individual advisors who are experts together with technical indicators

- Access to various trading currency pairs, CFDs, and cryptocurrencies

- Use the charting tools that are advanced to analyze how the market is performing at the present

- You can translate the platform into many languages

- Enhanced standards of security safeguarding your funds

- Compatibility with Windows, Linux, and Mac OS for the web-platform

- Ability to trade 24/7 from anywhere in the world

Meta Trader 5

This is software that is free and can be downloaded on your desktop or mobile devices for better trading experiences. You can use it on Android, Windows, or iOS, the choice is yours to make. It helps you trade on various instruments with the state of the art technology employed for faster and better trading. Get to analyze the market and use various technical tools provided by this software.

Soon this software shall replace the MT4 as the choice of many traders due to its advanced features. It has the best functions of the two with back-testing that is far more advanced than that of the MT4. This gives you a chance to test numerous pairs at once. It has a similar interface with MT4 helping users to transition easily without confusion between the two. It has more technical tools of the two and more charting and time frame options.

7 Features for MT5 are:

- 9 types of pending orders that get you control that are more precise over all the positions that are open.

- Trading in cryptocurrencies where it takes place as position or intra swing. You can even use scalping due to a new feature for hedging available on this platform.

- There is precise segregation on MT5 for transaction, position, and order terms.

- Use the economic calendar to stay on top of all crucial events, real-time indicators, and data of the whole financial market

- The EAs are improved with MQL Forex that's integrated with product tabs for the market.

- You can open a new position with one simple click simplifying the whole process

- Take advantage of time frames for charting numbering over 21, chart structuring that has 9 tools added to it, and many more technical tools at your disposal.

Trading Instruments

There are a wide variety of trading instruments you can trade on and diversify your portfolio. Think through what you want to trade on before you select the type of trading account to open. With this broker, you get instruments such as stock trading, cryptocurrencies, spot metals, Indices, Commodities, and Forex.

Forex

In the Foreign Exchange, otherwise known as Forex, you get to trade on the currency. This trade takes place in the form of pairs of currencies from all across the world. In trading, this instrument sees most of the action where the currency is bought and sold by traders. The exchange rate of the two pairs determines how much the currency is bought for or sold.

This market experiences the biggest trades with volumes reaching upwards of $6.5 Trillion daily. This is why the Foreign Exchange is the most liquid instrument in the world. Almost all traders make Forex part of their portfolio and trade on various pairs which are grouped into several categories. These categories are major, minor, and exotic currencies. Trade takes place 24 hours a day for only 5 days in a week as the market is closed over the weekend.

Spot Metals

Spot metals are precious metals like silver and gold that are the most stable instruments to trade on. Many traders opt for them as a part of diversifying their portfolio. You can trust that gold and silver will retain their value or experience minimal fluctuation no matter what. Since time in memory, gold has remained as a form of currency for traders all over the world and still retains its value up to date. It reduces the risk involved when choosing it as a trading instrument as it can withstand economic tough times and even war.

Spot metals are limited in supply hence their high value and reliability as stable trading instruments.

Shares

Traders can now access the stock market and trade on various shares. This is because of the straight feed from big markets like the NYSE and NASDAQ that provides real-time information on all these shares. This real-time accessibility enables traders to engage in trading with the right information on these shares. These shares are of the best companies in the world and preferred by many traders. You get to speculate on the movement of price and don't to own get the shares.

Commodities

This gives you a chance to trade on various commodities in the market and diversify your portfolio. This means you can spread the risk involved in trading. The commodities are numerous and even include gas and crude oil. You get to trade on the movement of their price as they rise or fall each trading day.

Cryptocurrencies

This new age has brought with it a new form of currency called Cryptocurrency that is embraced by many traders across the world. This currency comes in the form of Bitcoin, Etherum, Litecoin, and Ripple. All are stacked against the USD and this gives you another chance to diversify your portfolio.

How to Open a Demo Account on FXTM?

Setting up a live trading account gives you the opportunity to trade on various instruments diversifying your portfolio and increasing chances of earning a profit. It takes a few minutes to open an account but first read through all the different types to choose the one you want.

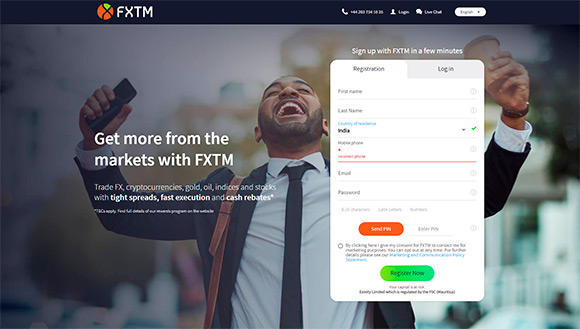

Follow these 7 simple steps to open an account on FXTM:

- Open a blank browsing page and input the ForexTime website.

- Once the homepage loads, navigate to the top right corner and click on 'Open Account'

- Fill in all the requested information accurately. Start with your First name, Last name, Country of Residence, Mobile phone number, Email, and a unique password.

- Click on 'Send PIN' to get a number on your phone that you must fill on the provided space.

- Accept to receive marketing info from the broker by clicking on the checking box.

- Finalize the process by clicking on 'Register now'.

- Follow this by funding the trading account

How to Deposit and Withdraw Money

You must deposit money into your trading account to start placing trades on all the instruments at your disposal. This broker makes it possible to use various methods for this process and all are easy to use. The methods you can use to deposit money are Fasapay, Dusupay, Africa, Latin America, TC Payment, Skrill, Local Bank Transfers, Online Banking, Globepay, Mastercard, Maestro, Visa, Neteller, Crypto, WebMoney, among others.

For withdrawal, you must use the same method to request a payout as used to fund the trading account. Navigate to 'My Transfers' on the homepage to view the status of your deposit or payout request.

Difference between FXTM and Other Forex Brokers

This is a reliable broker that has managed to prove it's worthiness by being honest and transparent in its operations. The information provided on the Education section is comprehensive covering all aspects of trading and how to get the best from this platform. You can use both the Meta Trader 4 and Meta Trader 5 for all your trading activities and the instruments available are numerous. Traders can enjoy having more than one live account option meaning beginners have a choice on a good starting account.

Pros

- Various deposit and withdrawal methods

- Three types of live accounts

- A demo account to train and practice trading skills on

- Easy registration process

Cons

- Can have more trading platforms

- Increase more languages for the website

Forex Time FAQ

⚖️ Is FXTM regulated in India, Nigeria, Kenya, South Africa, Australia and other countries?

Yes, this broker is regulated in all the regions and countries it operates from. It has licenses from authorities like CySEC, FCA, and FSA.

🙋 How to open an FXTM Demo Account?

Load the homepage and click on 'Trading'. Head to 'Trading Accounts' and click on 'Demo Account' to start the registration process.

🔐 How can you close an FXTM account?

With FXTM, you can close an account by navigating to 'Account Overview' then select the 'My investment Account'. Opt to Archive the account by clicking on the blue link.

🎁 Does ForexTime provide investors with any bonuses?

For now, there is no bonus from FXTM

⚙️ What instruments are can you access from this Forex broker?

Forex, Indices, Metals, Energies, Shares, Cryptocurrencies

📱 Does Forex Time have an app?

Yes, there is an official app that you can download on your Android or iOS smart device.

Conclusion

Opt to open an account with FXTM and benefit by trading with a reliable and trustworthy broker. It's managed to grow over the years to become a reputable and award-winning platform. There are numerous instruments to diversify your portfolio.