Plus500: Your Complete Guide and Review

When looking for an online broker that has managed to keep growing its services and keeps customers as a top priority, Plus500 is it. Founded back in 2008, this is an Israel-based company that has operations across the world. It's fully licensed and registered to operate as a trading platform that customers can trust and rely on daily. You get to access various trading instruments through it like CFDs, Forex, Indices, Commodities, Equities, Cryptocurrencies, and ETFs among others.

In 2013, this company became the pioneer to offer CFDs for Bitcoin among all other brokers in the industry. It's a publicly-traded company registered in the London Stock Exchange with a capitalization in the market for $2.25 billion. You can find this broker in more than 50 countries across the world. It makes use of the Plus500 Web Trader platform with about 2000 trading instruments at your disposal. By 2019, the company had made more than 35 million trades and had over 200000 active customers. The total traded value was more than $1310 billion.

This company leads the rest when it comes to trading CFDs (Contracts of Difference) and is owned by Plus500 Limited. It runs its operations under three subsidiaries namely Plus500AU Ltd., Plus500SG Ltd., Plus500IL Ltd, Plus500CY Ltd., and Plus500UK. All new traders get to earn a bonus on the first deposit they make on their trading account up to a maximum of $10000. You can translate the website into 32 languages making it more accessible to customers of diverse languages.

Is Plus500 a Reliable Forex Broker?

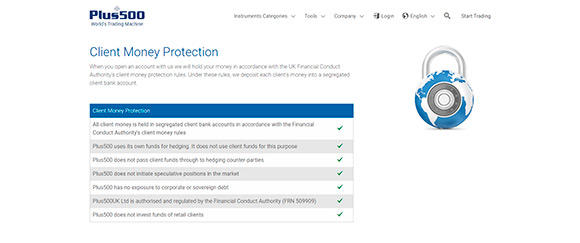

This is a reliable and safe FX broker to open an account with and start trading. It's taken the necessary steps to safeguard the interest of traders by being licensed and regulated in all jurisdictions it operates in. Through the five subsidiaries namely Plus500AU Ltd., Plus500SG Ltd., Plus500IL Ltd, Plus500CY Ltd., and Plus500UK Ltd it's registered under many authorities.

Within the EU, it's licensed and registered by CySEC (Cyprus Securities and Exchange Commission). This is under license number 250/14 for subsidiary Plus500 CY Ltd. Another authority that is highly respected and recognized is the Financial Conduct Authority (FCA) based in the UK. The registered subsidiary here is Plus500 UK Ltd.

Not only has it been licensed and registered within Europe but in many other parts of the world as well. In Australia, Plus500AU is licensed and regulated by AFSL under license number 417727. In South Africa, the same subsidiary is licensed and regulated by the FSCA and in New Zealand by the FMA under license number 47546.

Types of Trading Accounts

Opening a trading account with this broker is the first step to start creating an investment portfolio using the many instruments available. You must evaluate whether you're skilled enough to start with the live account or better suited using the demo account. The live account requires money deposited into it to start trading but with the demo account, you use virtual funds to practice.

Demo Account

As a beginner in trading, the best place to start your journey is the demo account. Here you get to practice all that you learn about trading and the strategies to use. The demo account doesn't charge any fee to open and uses virtual funds to practice trading in various instruments.

The virtual funds can't be withdrawn but the trading environment represents the real market that you'll engage in the live account. Get to learn how to trade, the best strategies that work for you, and different tricks before you start trading with real money.

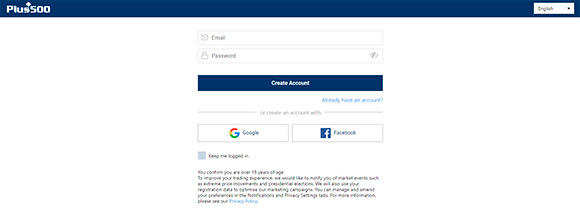

The following steps enable you to set up a demo account:

- Begin by launching a blank browsing page and input the Plus500 website www.plus500.com

- Once the homepage loads, locate the option on your screen written 'Try Free Demo' and click on it

- Fill in all the details requested by this broker including your email and preferred unique password

- Click on 'Create Account' then head to your email to verify the account by clicking on the provided link.

- Log into the account after the verification process and proceed to choose a demo platform to start trading.

Live Accounts

You require a live account to start trading using real funds deposited into it. You get two types of accounts to choose from depending on your level of expertise and the size of the investment you want to make.

- Retail Account

This is a basic standard account that's the best place to start as a new trader. Create it after testing your skills on the demo account. This is an account available to customers from the countries where Plus500 runs its operations. These are mainly EU countries, Australia, New Zealand, Singapore, among others. This account gives you access to 70+ pairs of currency among other tradable instruments like indices, commodities, shares, ETF. You can even trade on more than 10 of the top cryptocurrencies in the world.

The leverage you get depends on the asset you're trading and where in the world you're located. The wider world market has a maximum of 1:300, the EU 1:30, and Singapore 1:50. This broker allows its customers to set up more than one account for trading. With this Retail account, you get protected from a negative balance. You get 4 types of different stop orders and this company is a member of the ICF (Investor Compensation Fund). The minimum amount you can deposit is $100.

- Professional Account

This type of account best suits professional traders with years of experience under their belt. It's an account available to customers from the countries where Plus500 runs its operations. These are mainly EU countries and the UK only for this one. This account gives you access to 70+ pairs of currency among other tradable instruments like indices, commodities, shares, ETF. You can even trade on more than 10 of the top cryptocurrencies in the world.

It doesn't have many differences from the Retail/Standard account but customers should not it's not covered by the ICF. To maintain this type of account, maintain activity on it annually without fail. You are required to invest $500000 or more to be allowed to trade and must have experience in the financial industry.

Trading Platforms

Plus500 WebTrader

The one advantage that most traders will benefit from while using this platform is its user-friendly and easy to use interface. It's simply straightforward that even a beginner can understand it without any strains. It's among the few front ends that are purely online meaning you musn't download it like other platforms such as Meta Trader. It's easy to use as you start your trading activities and the language used is easy for any trader to understand. You can translate it into any of the 32 languages accepted by this website for easier understanding as well.

It has a low minimum deposit as compared to other platforms and also offers the ability to exchange on many more markets than is the norm. Although this trader is web-based, it's available for all the tradable instruments accessible through this broker. Many traders might think it's mainly for forex, but it gives you a chance to trade on cryptocurrencies, CFDs among others. This is all on the top markets of the world Including FTSE and NIKKEI.

You can access this web trader from any computer and with the mobile platforms becoming increasingly popular, mobile access is available as well. This platform comes with a wide variety of effective tools to help you manage the risks involved in trading. Some of these tools are important like the Close at Profit or Loss tool. This is a tool that is used when you're opening a position or have an order that's pending. You can even apply it when you have a position that's existing and you want to edit it. Keep in mind that this tool won't guard you against slippage and may lead to loss at times.

Another important tool offered is the Guaranteed Stop which is only applicable to positions that are new or pending orders.

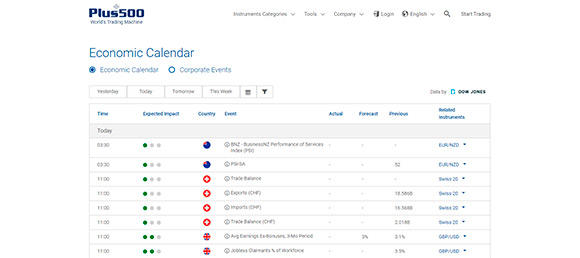

Updated Information

When trading, keep up to date with the latest information on the market to make the best trades of the day. Failure to do this might lead to losing important trading opportunities guaranteed to turn over a good profit. One tool that this platform provides to keep you up to date is the Economic calendar which keeps you aware of all the latest events in the industry. You know where the event is taking place and the main agenda.

Another feature to keep yourself informed is the Price Alerts. You set an alert to keep you informed of when a specific asset reaches a certain price to buy or sell. You get a notification in reaction to the movement of the price on your email or via SMS. Another alert comes in the form of the percentage change which notifies you when the price change reaches a set percentage.

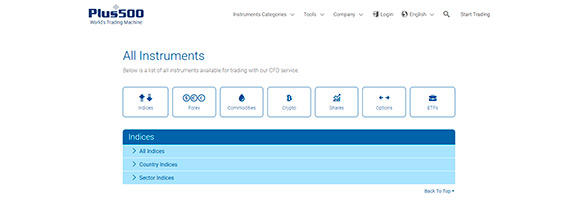

Trading Instruments

Through this broker, you get to trade in many instruments available in the market on various categories such as Cryptocurrencies, Forex, Indices, Commodities, Shares, Options, and ETFs.

Forex

Many traders flock the market in search of the best Forex to trade on daily hence why it's the most traded instrument in the world. Forex simply means the Foreign Exchange where traders get to buy and sell currency from all across the world. Despite it being a market, there is no physical location and all trade takes place online. The main currencies of the world from top economies are the favorite of traders and represent countries and regions. Currencies are traded in pairs and not individually.

The main currencies of the world called the major currencies dominate the market with many traders enjoying their stability and volatility as compared to others. These currencies are the GBP (Great British Pound), JPY (Japanese Yen), USD (US Dollar), and the EUR (Euro). They must be traded in pairs as per the rules of Forex trading and are grouped into major, minor, and exotic currencies. The exchange rate between the two determines the price at which they shall be bought and sold on the market. An example of a currency pair is USD/EUR.

Note that the forex market is open 24 hours a day because of different time zones of major markets. You can only trade for 5 days a week given that it's closed during the weekend. Transact your trades by opening deals at the start and closing them by end of the business day. To get the profit you've earned in a completed trade, subtract the price of the two currencies from the time you opened the deal to closing time. Trade in over 60 currency pairs that have a maximum leverage of up to 1:300. The minimum deposit to start trading forex is $300.

Test your knowledge and skill in forex trading by using the demo account for starters. Here you use virtual funds that have zero risks involved. Using a live account before you test your skills will only lead to you losing the money you invest because of not knowing how to trade.

Commodities

The commodities you get from this trading platform include spot metals like silver and gold that are known for their stability in the market. Commodities are a great way to diversify your portfolio and spread the risk involved in online trading. This increases your chances of turning a good profit at the end of the day. All the commodities you trade on have fluctuating prices that you speculate on but never get to own the underlying asset. The different commodities you can expect to find on eToro are Gold, Silver, Wheat, Gas, Copper, Oil, Palladium, Platinum, Cocoa, Cotton, Sugar, Nickel, and Aluminum.

Stocks

Trading in the stocks of the major companies in the world is another great way to diversify your portfolio and spread the risk involved. You get feeds of the top markets in the world in real-time and get to speculate on market prices. This is done without ever owning the shares themselves. All you need is the price when opening the trade and one when closing it. The major markets in the world are like NYSE.

Cryptocurrencies

Cryptocurrencies are the new beloved choice for many traders for their uniqueness and simplicity. With eToro, you can access many of them including Bitcoin, Etherum, Litecoin, Ripple, Dash, among others. This diversity gives you a chance to speculate on more than one type at a time. This increases your chances of turning a profit. The fact that cryptocurrencies are purely online attracts many traders hence their rise in popularity.

Indices

This broker enables you to trade in some of the most popular indices from across the world. All indices are traded with leverage and you don't use large sums of cash to do so. The maximum leverage accepted is up to 1:300 and you can start trading with a minimum of $100. You get index quotes that are real for free and can set alerts for prices and other important notifications about the market.

ETFs

ETFs are Exchange Trade Funds and here you get to trade on the most popular in the market today. You can control the amount of profit or loss you incur by setting Stops and Limits for all positions for free. The maximum accepted leverage is up to 1:100 and trades start from as low as $100.

How to Open an Account

Once you're ready for a live account, you can then proceed to register one. Deposit the money into it to start trading on all the accessible instruments.

To open a trading account, follow these 5 steps:

- Open a blank browsing page and input the Plus500 official website.

- Once the homepage loads, click on 'Start Trading Now' to begin the registration process.

- Fill in your preferred username and password on the provided spaces

- Fill in your phone number and verify it. Input the code that comes to your phone via SMS on the provided space on the form.

- Complete the process and proceed to deposit money into your account

How to Deposit Funds

![]()

To be able to use your live account for trading, you must deposit money into it. There are various methods you can use to fund your trading account depending on the one you want to use. These methods include Visa, Maestro, Mastercard, Skrill, Paypal, and Direct Bank Transfer. The process to deposit is easy and takes only a few minutes to complete.

- Open a blank browsing page and input the Plus500 website.

- Once the homepage loads, click on 'Funds Management' then proceed to click on 'Deposit'

- Select the method you prefer to for the transaction then complete the next field before finally clicking on 'Submit'.

Note that each method you use has its minimum and maximum amount to transact. Be sure to only use the methods available in your country or region.

How to Withdraw Money

Withdrawal requests for this platform are processed within 1 to 3 business days and also depend on the method you use. You must use the same method to withdraw as used to deposit the money as per the Terms and Conditions of the company. Keep in mind the limits of each method.

- Open a blank browsing page and input the Plus500 website.

- Once the homepage loads, click on 'Funds Management' then proceed to click on 'withdraw'

- Fill in the amount you want to withdraw and select the method to use.

- You must wait for the money to be processed before it can reflect in your account.

Is Plus500 a Reliable Broker?

This is a company regulated in many jurisdictions in the world by some of the top regulators in the industry. This ensures the customer is safe and secure while using this broker for trade purposes online. These regulators ensure the company has the best interest of the consumers and that it provides the best services as well. It's transparent and honest in its services meeting all the requirements of a trading platform.

It has a customer support system with agents available 24/7 to assist you in any way. Simply initiate a chat from the pop up on your screen and make your inquiry. An agent will engage you immediately and answer your question if possible to give an immediate response. You can even send an email for further assistance.

This company uses the latest SSL encryption to ensure its entire client data is safe and secure at all times. This guarantees you a safe and secure trading environment always.

Pros

- Licensed and Regulated in multiple jurisdictions

- Have a 24/7 customer support system

- Easy to register and use the demo account

- Numerous trade instruments

Cons

- Little Educational material and content for novice traders

- No phone support in customer service

- Trading platform is limited in terms of customization features

Plus500 FAQ

⚖️ Is Plus500 regulated in India, Nigeria, Kenya, South Africa, Australia and other countries?

Yes, this Forex broker is regulated in all the regions and countries it operates from. It has licenses from authorities like CySEC, FCA, ICF, FSC, among others.

🙋 How to open a Plus500 Demo Account?

Opening a demo account is simple as you only click on 'Try Demo Account' on the homepage. Follow this by completing the requested information on the form then click on 'Register'. Proceed to your email to click on the link sent and activate the account.

🔐 How can you close a Plus500 account?

To delete an account with this broker, you must contact the customer service and give them a reason for this decision. This is followed by writing an official email stating you want to delete the account then the company will proceed.

🎁 Does Plus500 provide investors with any bonuses?

Yes, there are bonuses provided by this broker but are currently only available for Plus500 Australia.

⚙️ What instruments are can you access from this broker?

Forex, Commodities, Stocks, Cryptocurrencies among others.

📱 Does Plus500 have an app?

Yes, there is an official app that you can download on your Android or iOS smart device. It has a user-friendly interface and is fully functional.

Conclusion

Finding the right broker especially as a novice trader takes time and patience. With Plus500, you get a platform that is regulated in multiple jurisdictions. It's however not accessible to many countries in the world. Check if you reside in the 50 countries it operates in.