Tickmill: Your Complete Guide and Review

As a trader, the best decision you can make is to open a trading account with a reputable broker that caters to your needs. Tickmill is an award-winning company that has managed to create a name for itself in the industry as one that delivers quality services. You can trade in premium products that meet all the industry standards knowing you're in a safe and secure trading environment always. It was founded by Tickmill Limited which is part of the larger Tickmill Group and is fully licensed and regulated to function as a broker.

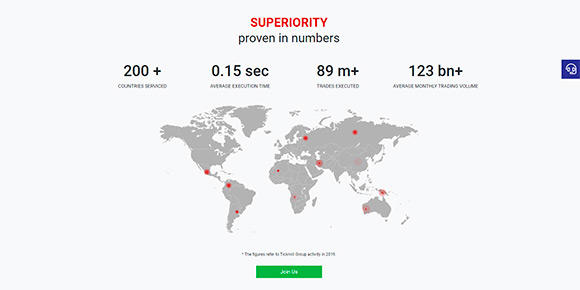

It currently has a total of 263000+ registered accounts with 111000+ customers satisfied with its services and platform. Over the many years, it's been operational, this broker has managed to trade more than $215Million and has 150+ employees spread all over the world. Once you register a live account, you can access80+ trading instruments. These instruments have spreads starting from as low as 0.00 pips.

The times for execution are quite impressive compared to that of other brokers in the industry. Expect no requotes and average speeds of 0.15 seconds. Platforms used to trade are Meta Trader 4 and Web Trader.

Is Tickmill a Reliable Forex Broker?

This company has been operating as a broker since 1994 and even though other companies came and overtook it in terms of trade, it's still standing strong. Many traders trust it as an honest and reliable broker because it's fully licensed and regulated. It adheres to all the industry standards and only delivers quality services to its customers.

It's licensed and regulated by some of the most reputable authorities in different parts of the world hence its global reach. For starters, it's licensed and regulated by the Financial Services Authority (FSA) under license number SD008. This authority operates from Seychelles and works to license, supervise and develop the brokers.

The FCA (Financial Conduct Authority) is another authority that has licensed and regulates Tickmill under license number 717270. It's based in the UK and works to regulate the conduct of financial institutions and protect the interests of consumers. CySEC is the regulator that oversees the operations of this broker within the EU under license number 278/15. It safeguards the interests of all European investors.

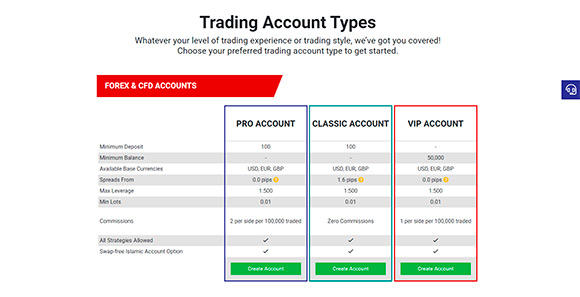

Types of Trading Accounts

As a trader, you can open three types of live accounts on this platform depending on your requirements and the minimum amount you can deposit. Apart from these three main accounts, you have the swap-free feature to turn any of them to an Islamic account adhering to 100% Sharia Laws. Also, as a beginner, the best place to start is with a demo account to practice your trading skills without the fear of losing all your money. There are a lot of educational materials you can use to learn all about trading and practice on this account.

Demo Account

The demo account accords you an opportunity to trade without using any real funds from your live account. Here, you get virtual funds that enable you to have real trading experience. With this, you can sharpen your trading skills without the risk involved in live accounts.

With the demo account, you get to take part in real trading under market conditions that exist in real-time, test all the different tools available, and use all the strategies you've learned and created for trading. You can utilize the MT4 platform with all the advanced tools and features that sharpen your trading skills getting you ready for the live accounts. All the trading instruments are available on the demo account.

To open a demo account:

- Load a blank browsing page and input the Tickmill website www.tickmill.com

- Once the homepage loads, click on 'Trading' then head to 'Trading Accounts'

- Scroll down and click on 'Demo Account'

- Fill in all the requested information correctly

- Input your First Name, Last Name, Email, and Phone Number

- Select the type of account you want and the currency for this live account

- Select the amount you want as virtual funds and the maximum leverage

- Click on the checking box to agree to submit all this requested information to Tickmill Ltd.

- Complete the registration process by clicking on 'Open Demo Account'.

- You can start trading and learning as much as possible before moving on to a live account.

Live Accounts

- Pro Account

To open the pro account, you must deposit a minimum of $100 into the account using the methods approved by the broker. The currencies accepted to transact in this account apart from USD are EUR and GBP. Spreads for this type of account start from as low as 0.01 pips with minimum lots of 0.01 and maximum leverage of 1:500. There is a commission charged on this account of $2 per every trade of $100000. You can use all types of trading strategies here and are allowed to use the Swap-free option to switch the account to suit Islamic Sharia Laws.

- Classic Account

To open the pro account, you must deposit a minimum of $100 into the account using the methods approved by the broker. The currencies accepted to transact in this account apart from USD are EUR and GBP. Spreads for this type of account start from as low as 1.6 pips with minimum lots of 0.01 and maximum leverage of 1:500. There is zero commission charged on any trades made. You can use all types of trading strategies here and are allowed to use the Swap-free option to switch the account to suit Islamic Sharia Laws.

- VIP Account

To open this account, there is no minimum deposit expected but you must maintain a minimum balance of $50000 at all times. The currencies accepted to transact in this account apart from USD are EUR and GBP. Spreads for this type of account start from as low as 0.01 pips with minimum lots of 0.01. There is a commission charged on this account of $1 per every trade of $100000. You can use all types of trading strategies here and are allowed to use the Swap-free option to switch the account to suit Islamic Sharia Laws.

Trading Platforms: Meta Trader 4

The MT4 available on this broker makes it even easier to trade on a wide range of instruments diversifying your portfolio. You can opt to use it directly on the Tickmill website instead of having to download and install it on your computer or mobile device. Simply click on it and it launches on a new window and you can start trading from anywhere in the world no matter the time. The interface is user-friendly and as detailed as the usual MT4 interface but has enhanced security features to safeguard your details.

Access the one click function that you use to open and close trades, manage all the risks effectively, and make use of all the charting tools at your disposal. Here you get low spreads from as low as 0 pips and a fast execution rate of 1.5 seconds.

Features of MT4:

- Time Frames numbering 9 in total

- Positions that are locked

- 128 encoding bit for heightened security

- Stop Trailing

- Trading with one click

- Trading that's automated

- Financial market news

- Technical analysis tools

- More than 30 indicators

Trading Instruments

To successfully trade on this platform, use any of the provided instruments. Here you have access to global markets on Forex, Stock Indices and Oil, Precious Metals, and Bonds.

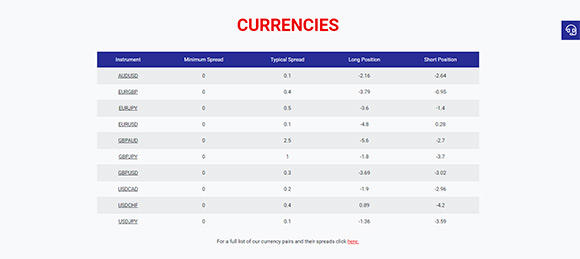

Forex

You can trade on more than 60 pairs of currency from all over the world on this forex. Forex is simply a short form for Foreign Exchange which is a market where traders trade on currency pairs from all across the world. This transaction has both buyers of currency pairs and sellers. Keep in mind the exchange rate between two pairs of currencies when buying or selling.

The forex market experiences the most trade of any other instruments ever with upwards of $6.5 trillion every day making it have the highest liquidity of any other industry. This is why this market attracts the highest number of active traders daily who take party in active trading. This market is active 24 hours a day for 5 business days of the week. No trading occurs over the weekend.

The Forex market has no main headquarters and all activities take part online with a huge percentage of traders being speculators of currency. When you decide to trade on Forex on Tickmill, you can benefit from spreads that start from as low as 0.0 pips. You have access to more than 60 different pairs of currency and the rate of execution lies at 0.15 seconds which is faster than other brokers in the market. You can utilize any trading strategy you want and the maximum leverage is 1:500.

Examples of currency pairs are USD/JPY, USD/CAD, and EUR/GBP. Each currency is valued according to the demand and supply it has in the market which is how the rate of exchange is determined.

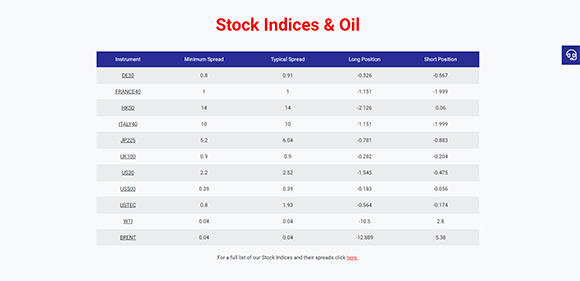

Stock Indices and Oil

When you come across the term Stock Indices this simply means stocks that are grouped for the purpose of buying or selling them as one instrument of trade. Traders get to speculate on how the price for these stock indices can change either going high or low. This is similar to those traders who speculate on the price change for certain assets. Many traders use the stock indices to determine the health of the economy as a whole for a particular country.

When it comes to how they're classified, here is where it gets a little complex. An example is the DAX 30 which represents the top 30 German companies grouped as one index. These are then traded on the German Stock Market and are used to indicate how healthy or not the German economy is as a whole. Still, it's important to note that indices are not only limited to countries but can be regional as well.

Once you decide to trade on indices on this platform, you can benefit from spreads that start from as low as 0.0 pips. This gives you access to more than 14 different indices to trade on with an average speed of execution being 0.15 seconds.

Precious Metals

For a beginner, precious metals are the best tradable instruments to start with for their stability. You can trade on gold and silver without having to own them physically. Many traders use precious metals to diversify their portfolio and reduce the risk involved making them safer options. Gold is one metal that retains its value no matter what the political or economic condition a country is experiencing, not even war.

Because these two metals are limited in supply they have a higher value than others and can even be used to transact. To trade on these precious metals, you can benefit from crosses for both gold and silver. Spreads start from as low as 0.0 pips and the maximum leverage is 1:500. Make use of all the trading strategies you want for there is no limitation and the rate of execution is 0.15 seconds.

Bonds

Bonds are defined as agreements made between lenders and borrowers. The borrower gets to use the bond to finance a project they have. Governments are the ones that issue bonds which are also called treasuries or securities. The borrower who is the government determines the interest rate which is paid to the one loaning out the money. When the bond matures, the lender is paid back the loaned sum plus the accrued interest.

Bond markets are bigger as compared to the stock market and the transaction doesn't involve actual buying of the bond. You role is to speculate on the value of the bond depending on appreciation or depreciation. On this platform, you have access to German bonds that have a spread that starts as low as 0.0 pips.

How to Open a Tickmill Account

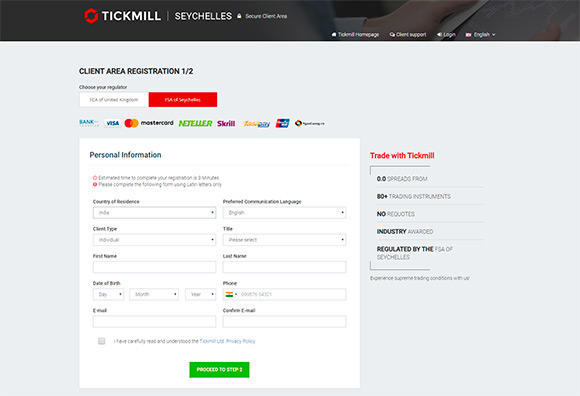

You should set up a live account when you finally want to start trading with real money. The process of registration is easy and no fees are charged to open a trading account. All you are required to do is keep in mind the minimum amount to deposit for each type of account.

- Open a blank browsing page and input the Tickmill website.

- Once the homepage loads, navigate to the top right corner of the page and click on 'Create Account'

- Fill in the form as requested and start by selecting your preferred regulator

- Fill in your Country of residence, Preferred language for communication, Type of Client, Title, First name, Last name, Date of Birth, and Phone number.

- Fill in your email and confirm it on the next provided space

- Click on the checking box to confirm you have read all the Terms and Conditions

- Click on 'Proceed to Step 2'

- Input the Country of residence again, State/Region, City, Street name, and Zipcode.

- Fill in the tax identification number, details of your identification, education and employment details, and financial background

- Answer the questions on the level of trading experience you have

- Input the number of an Introducing broker, create a unique password, and click to agree to receive the company newsletter.

- Click to agree you've read all the details of the Client Service Agreement then end the process by clicking on 'Open Account'.

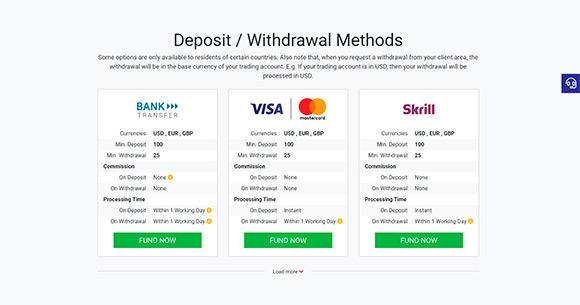

How to Deposit and Withdraw Money

To use a live account to trade, you need money deposited into it. There are different payment methods provided by this broker that make it easy to transact from where you are across the world. This platform gives you better control of your account making it easier to deposit or withdraw money. Keep in mind those transactions that are above $5000 is only made using the bank wire transfer as one complete transaction.

The same method you use to deposit money applies when you withdraw as well. The same currency has to be used in both currencies which means if you deposit in EUR then you use the same to withdraw. All the methods here have different limits for the minimum amount you can deposit and withdraw. These methods are the Bank Wire Transfer, Skrill, Neteller, Visa, and Mastercard.

To deposit money:

- Log into your client area using your username and password

- Navigate to the left side of the dashboard and click on 'deposit' to start the process

- Select the account to deposit into then select the payment method to use in this transaction.

- Fill in the amount you wish to deposit into the selected trading account and the currency used

- Click on 'Submit' to complete the process.

To withdraw Money:

- Log into your client area using your username and password

- Navigate to the left side of the dashboard and click on 'withdraw' to start the process

- Select the account to withdraw from then select the payment method to use in this transaction.

- Fill in the amount you wish to withdraw from the selected trading account and the currency used

- Click on 'Submit' to complete the process.

There are no fees charged for these transactions.

How is Tickmill Different from other FX Brokers?

Tickmill is not the ideal broker for a beginner because the minimum amount you can deposit on a trading account is $100. Many other brokers have lower amounts to start with. It's best suited to professional traders with more experience and can utilize as much of the platform as necessary. The instruments provided are diverse and you can make your portfolio to be as detailed as possible. Tickmill has a demo account to practice your trading skills and reflects a real trading environment.

Pros

- Different types of trading accounts

- Licensed and regulated to operate from all across the world

- has a detailed education section with the live webinar to help you learn as much as possible on trading

- has a demo account with virtual funds to practice your trading skills

Cons

- High minimum deposit for a trading account

- Account registration process is too long compared to other brokers

FAQ

⚖️ Is Tickmill regulated in South Africa, India, Nigeria, Kenya, Australia and other countries?

Yes, this broker is regulated in all the regions and countries it operates from. It has licenses from authorities like CySEC, FCA, and FSA.

🙋 How to open a Tickmill Demo Account?

Load the homepage and click on 'Trading'. Head to 'Trading Accounts' and click on 'Demo Account' to start the registration process.

🔐 How can you close a Tickmill account?

With Tickmill, you can close an account, but the company retains all your information for of 7 years as per the company policy.

🎁 Does Tickmill provide investors with any bonuses?

There is a 30% bonus to welcome you to Tickmill once you successfully register a live account. You are not required to deposit any funds and you can withdraw all the profits you earn using the bonus.

⚙️ What instruments are can you access from this FX broker?

Forex, Indices, Metals, Energies and oils, Bonds.

📱 Does Tickmill have an app?

Yes, there is an official Tickmill app that you can download on your Android or iOS smart device.

💵 What methods can you use to deposit and withdraw money from your trading account?

These methods are the Bank Wire Transfer, Skrill, Neteller, Visa, and Mastercard.

Conclusion

This is a reliable company with years of experience in the industry. You can use it to open a live trading account and a wide range of instruments to diversify your trading portfolio. Take your time as a beginner to read all the information on the Education section of the Clients Tools. Apply all you learn on the demo account using the virtual funds. After that, open a live account and start trading. You get a welcome bonus of 30% and retain all the profits you get.

Trading takes time to master so be patient with your trades. Investing online carries a level of risk which is an important point to keep in mind. The trading platform to use if MT4 with all the benefiting features it has.